What Are The Minimum Down Payment Requirements?Įach type of mortgage has slightly different minimum down payment requirements. Fortunately, all you have to do is make the minimum down payment required by your mortgage lender. Saving up 20% of a home’s purchase price could take years, depending on the home you want to buy. While making a 20% down payment has its perks, it’s not feasible for every aspiring homeowner. However, mortgage insurance can cost a few hundred dollars a month, so you may want to avoid it by making a higher down payment. This insurance gives them extra financial protection in case you default on your mortgage payments in the future. Most lenders require you to buy mortgage insurance if you put less than 20% down. Have more equity in your home right away even as a borrower initiallyĪnother benefit of making a 20% down payment is that you won’t have to purchase any mortgage insurance.Enjoy a less expensive monthly mortgage payment.A larger down payment will also allow you to: Thus, the less money you borrow, the less interest you’ll have to pay in the long run. When you take out a mortgage loan, you have to pay interest on every dollar you borrow.

By making a smaller down payment, you can become a home buyer a lot sooner.

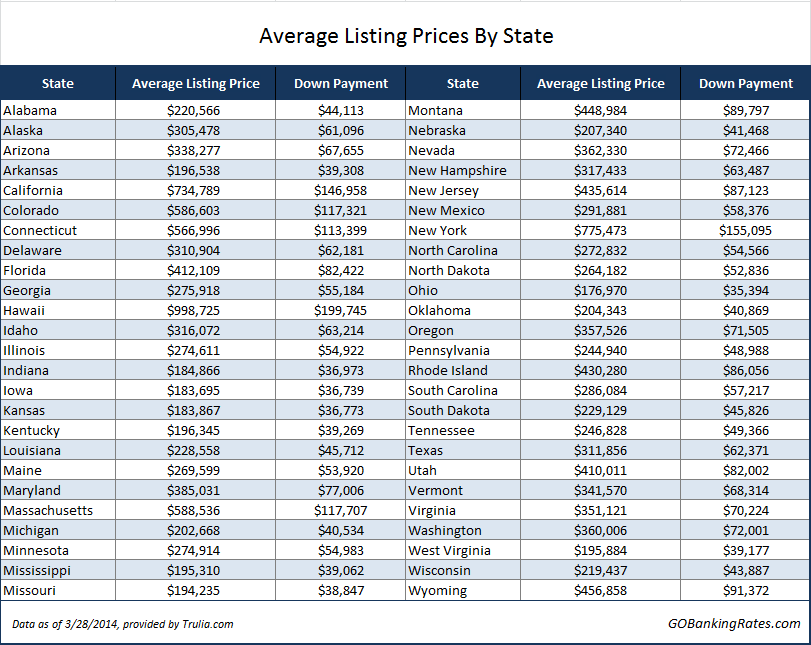

The average down payment for first-time homebuyers is 7%. If the home you want to buy costs $500,000, you would need to put $100,000 down to reach this 20% benchmark.Īs you can see, a 20% down payment requires a substantial amount of savings, depending on the home price.įortunately, you don’t have to put down 20% if you don’t want to. Historically, many real estate experts have recommended any home buyer make a down payment of 20%.

What is the Typical Down Payment on a House? As you make monthly mortgage payments, your equity in your home will gradually increase until you own your home outright. The rest of your home technically belongs to your lender until you pay them back. You use this $30,000 to make a down payment of 10% and finance the remaining 90% with a mortgage of $270,000.Ī down payment represents your initial ownership stake in your new home. However, you only have $30,000 in savings that you can pay upfront. Down payments are usually expressed as a percentage of a home’s total purchase price.įor example, let’s say you want to buy a home that costs $300,000. So how much money should you put towards your down payment?īelow, we’ll explain how you can choose the best down payment amount for your financial situation.Ī down payment is the amount of money you pay upfront to purchase a home.

Unless you have hundreds of thousands of dollars sitting in the bank, you’ll likely need to finance your home with a mortgage.Įven with a conventional mortgage, you usually still need to pay a percentage of the home’s price upfront in the form of a down payment. After all, a home is one of the most expensive purchases you’ll ever make. If you’re like most people, you probably can’t afford to buy a home outright with cash. How Much Money Should You Put Down On A House? As long as you meet your mortgage lender’s minimum requirements, the right down payment will depend on your financial situation.

0 kommentar(er)

0 kommentar(er)